Portfolio Management for the Paranoid

Trust is the bedrock of markets. When we enter our credit card info on an e-commerce website we have never before visited we trust that:

(1) they will not misuse our data

(2) they will ship us the goods we have purchased

If you’re like me, you may have been lucky to grow up around trustworthy individuals. Banks, businesses, and bureaucrats would deliver as promised. When they did not, it was an anomaly.

But most people around the world did not have this privilege growing up. Banks would close or institute withdrawal limits without notice. Trustworthy businesses were the exception and not the rule. Government regimes would be here one day and gone the next.

It is no surprise then that some of us are more trusting than others. And there are surely more factors at play than the institutions with which we were raised.

But trust is not the same as risk tolerance.

Think about how many trusting people have little appetite for risk and vice versa.

Financial advisors do not always take this into account.

A financial advisor may tell a 50-year-old with moderate risk tolerance saving for retirement that 60% of their portfolio should be in stocks with the remaining 40% in bonds.

This is probably good advice! But the individual is hesitant to invest. “How do I know the funds you’re recommending are safe? What about Bernie Madoff?”, they may ask.

The financial advisor may counter by saying, “Oh, with these funds, that would never happen.”

“Never?”, the investor may respond. “Have you seen the world we live in?” they say.

The conversation breaks down and one of two suboptimal outcomes occurs:

- The investor leaves the advisor's office. Their money sits in a bank (or under the mattress) earning little to no return.

- The advisor calms down the conversation and recommends a lower-risk investment strategy. This is also a bad outcome since the investor tolerates higher risk so long as they can trust the funds are acting with their best interest in mind. Thus, they are likely leaving return on the table.

How many investors like this do we know? Probably dozens, if not more. And who can blame them? When they turned on the news earlier this year and saw headlines that the U.S. may default on its debt—a supposedly “risk-free”security—of course they would be hesitant to invest. (If you’re still not convinced these investors were acting rationally, recall that the “smart money” was actively bidding up the price of U.S. credit default swaps, implying a roughly 1 in 25 chance of default).

There are some basic tactics so-called “paranoid” investors can use to sleep easier at night.

Split Investments Across Multiple Funds in the Same Asset Class

The S&P500 ETF SPY is a popular choice to get exposure to the U.S. stock market. And for good reason: it has low fees and a relatively long track record.

I believe the risk of a cyberattack, financial fraud, or other catastrophic event that causes SPY to plummet in value relative to its underlying investments is quite low (i.e., much closer to 0% than 1%). However, I cannot look someone in the eye and say there is a 0% chance of such a catastrophic event.

Thus, paranoid investors seeking to get exposure to the S&P 500 may choose to divide their investments across more than one S&P500 ETF or mutual fund.

Invest in Foreign Stocks

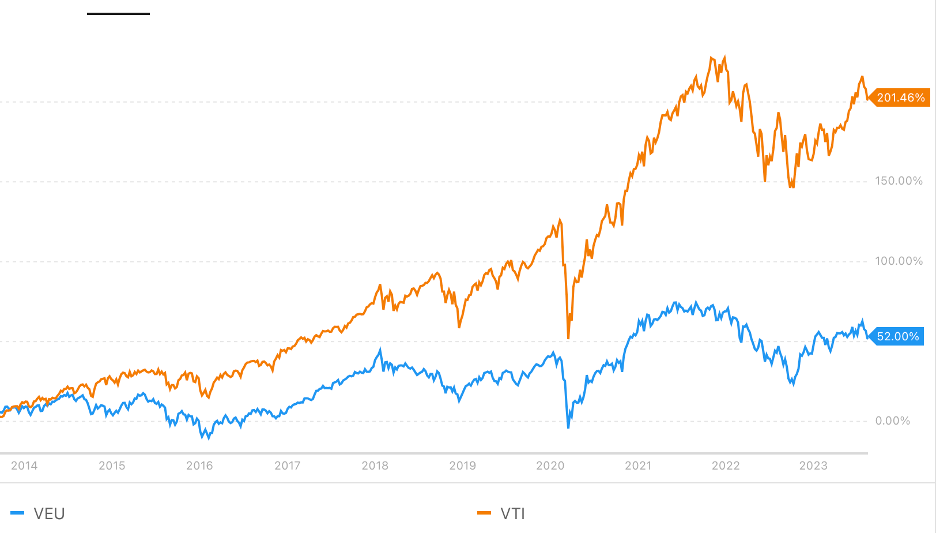

Over the last 10 years, U.S. stocks have outperformed foreign stocks. Here’s how a Vanguard U.S. total market ETF (VTI) fared versus Vanguard’s world market ETF that excludes the U.S. (VEU):

If you were to use a tool like Portfolio Visualizer to optimize a portfolio, it may tell you to allocate 0% of your assets to VEU for this reason. Intuition backs this up: the U.S. has had a recession roughly every 6.5 years, but otherwise has experienced incredibly strong growth. One may reason its stock market should follow a similar pattern (and it largely has!). But will this trend continue in the future? Probably – but I don’t know for sure. Anyone who is telling you this will definitely be the case is someone you should be skeptical of.

Let’s take a look at the Japanese stock market.

Before 1990, the market earned an incredible return. However, if you invested at its peak in December of 1989, you would still be waiting on a positive return more than 30 years later!

If I were pressed, I would say it is more likely than not that we would see the same outcome in the U.S. But it’s possible! Therefore, to hedge against this possibility, the paranoid (and even non-paranoid among us) should consider investing some of their money in foreign stocks—even if their more recent returns have been lackluster.

Cap Your Downside

A more sophisticated individual investor may decide to short a stock. Even a paranoid investor may choose to do so.

When an investor buys (goes “long”) a stock the most they can lose is 100% (if the stock goes to $0), but they can make an infinite amount of money (the stock price, in theory, could go to infinity).

When an investor shorts a stock, they face the opposite dynamic: the most they can make is 100% if the stock goes to $0, but they can lose an infinite amount of money if the stock price soars.

Luckily, there is another tool investors can use to get exposure to the decline of a stock price: a put option. “Puts” give investors the right to sell a stock on or before an agreed-upon date at an agreed-upon price. While investors must pay a premium for this right, they have a desirable feature compared to shorts: the investor can lose no more than the premium paid for the option.

Of course, puts have downsides, too. For example, an investor must not only be right about the stock price declining, but they must also be right about when it declines. After all, if the stock price decreases 50% after the option’s expiration date, the investor may have lost 100% of their investment in the option. They also failed to realize any upside associated with the stock price’s decline.

That said, the magic of buying put options is that they keep you in the game. The only way to be an investor is to continue to have money in a brokerage account. If you have a short and the stock price triples, your days of investing may be over for a while. Put options do not pose the same risk.

As always, thank you for reading and please see my disclosures here.